Forex pairs with highest volume

Evaluates the monthly change in overall production by all sectors of the Japanese economy.

The Top 3 Forex Pairs to TradeThe index comprises a variety of industries: The index closely follows Japanese GDP and overall growth figures, providing insight into current levels of Japanese economic expansion. The All Industry Activity Index is posted monthly as a percentage change from the previous month's figure.

Records sales of previously owned homes in the United States. This report provides a fairly accurate assessment of housing market conditions, and because of the sensitivity of the housing market to business cycle twists, it can be an important indicator of overall conditions at times when housing is particularly important to the economy.

While used home sales are not counted in GDP, they do affect the United States economy. Sellers of used homes often use capital gains from property sales on consumption that stimulate the economy. Higher levels of consumer spending may also increase inflationary pressures, even as they help grow the economy.

The existing home sales report is not as timely as other housing indicators like New Home Sales or Building Permits.

By the time the Existing Home Sales are recorded, market conditions may have changed. The actual inventories of crude oil, gasoline, and distillate, such as jet fuel, as reported on a weekly basis. The numbers are watched closely by the energy markets, and if the results differ greatly from the expected inventory levels, the market can react strongly. The inventory data can be skewed by holidays and seasonal factors.

Weekly data can be unreliable and should be viewed as a part of longer-term trends, so a four-week moving average may be more useful. The Reserve Bank of New Zealand RBNZ releases this statement in connection to its recent decision on short-term interest rates.

Dukascopy Community - Dukascopy Community

Interest rates are a primary determinant of a currency's value and these statements are used by traders to determine future monetary policy decisions. A country's trade balance reflects the difference between exports and imports of goods and services. The trade balance is one of the biggest components of the Balance of Payment, giving valuable insight into pressures on country's currency.

Surpluses and Deficits A positive Trade Balance surplus indicates that exports are greater than imports. When imports exceed exports, the country experiences a trade deficit.

Because foreign goods are usually purchased using foreign currency, trade deficits usually reflect currency leaking out of the country. Such currency outflows may lead to a natural depreciation unless countered by comparable capital inflows inflows in the form of investments, FDI - where foreigners investing in local equity, bond or real estates markets. At a bare minimum, deficits fundamentally weigh down the value of the currency.

Ramifications of Trade Balance on Markets There are a number of factors that work to diminish the market impact of Trade Balance upon immediate release. The report is not very timely, coming some time after the reporting period. Developments in many of the figure's components are also typically anticipated well beforehand. Lastly, since the report reflects data for a specific reporting month or quarter, any significant changes in the Trade Balance should plausibly have already been felt during that period - and not during the release of data.

However, because of the overall significance of Trade Balance data in forecasting trends in the Forex Market, the release has historically been one of the most important reports out of the any country. Gauge for goods sold at retail outlets in the past month.

Retail Sales is a leading indicator for the economy. Rising consumer spending fuels economic growth, confirms signals from consumer confidence, and may spark inflationary pressures.

This index characterizes the volume of new orders in the industrial sector. The growth of industrial orders is a sign that the economy expands. Increase in orders leads to higher employment in the industry. Increase in orders will lead to further growth in manufacturing, and hence lead to growth of the national currency and domestic stock market. In the bond market, this leads to an increase in profitability of government securities.

The index is certainly important for the market. Sometimes a strong deviation from the forecast values of the index can cause a strong change of the pound sterling rate. Certainly, the indicator is not able to deploy the prevailing trend.

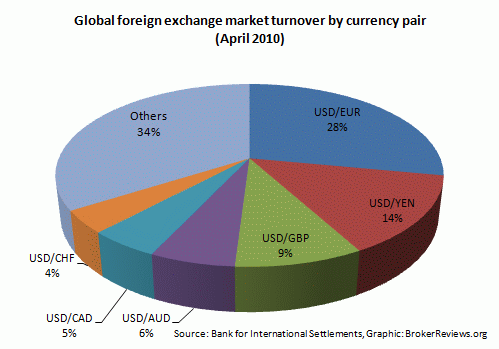

The trades volume on a currency pair shows the rate of involved assets in trading the particular pair compared to the market volume. The trading signals silver volume allows to monitor the total investment volumes of bulls and bears buyers and sellers in a currency pair.

The trade volume together with the currency trades rate reflect the interest of traders in the pair on the foreign exchange market. The advantage of this indicator is the opportunity of getting the information about the real trade volume on a currency pair without binding to the trade number, as a lots position has larger impact on the market than five 1 lot deals.

The extreme increase of volume on a currency pair means the start of a new trend. The volume decline marks the decrease of the interest in this currency pair and high probability of a sideways forex pairs with highest volume.

Analytics Calendar Forex news Forex analysis Video news Prime News Photo News Interview Subscribe to Newsletter. Forex Info Trading Forex signals Brokers review Indicators Forex Articles Advisors MQL Forex trading hours Meta Trader 5 Forex RSS feeds Forex Catalogue Interesting to know About Forex Forex book reviews National Holidays Video tutorials Developing countries Dossier MT5 Forex Glossary Promo items.

Currency Pairs

Tools Quotes online Forex charts Forex-calculator Volatility calculator Forex tick charts Forex informers Currency converter Forex symbols. Relax Forex Contests Forex Forex trading or stock options Forex Games Forex trading tutorial hindi pdf Cinema Festival.

Verdana, Arial, sans-serif; font-size: M5 M15 M30 H1 H4 D1 W1 EURUSD 1. Currency pair Bid Ask EURUSD 1. Monetary Policy Meeting Min Monetary Policy Meeting Minutes Period: The Bank of Japan publishes the summary from its monthly monetary dead money makers meetings some time after the actual meeting.

MI Leading Index Period: All Industries Activity Period: Public Sector Net Borrowing. Public Sector Net Borrowing Period: Public sector net borrowing is the measure of fiscal surpluses and deficits along with the amount of new debt created. If this number is positive, it means the U. MPC Member Andy Haldane Spe MPC Member Andy Haldane Speaks Period: He was acknowledged as being one amongst the world's most influential people. His speeches are mainly focused on financial stability, monetary issues and market risks.

SNB Quarterly Bulletin Period: Tends to have a mild impact because much of the information is released 2 weeks earlier in the Monetary Policy Assessmen. Existing Home Sales Period: The headline is the total value of properties sold. Crude Oil Inventories Period: Official Cash Rate Period: The Official Cash Rate OCR is the interest rate set by the Reserve Bank to meet the inflation target specified in the Policy Targets Agreement PTA.

The current PTA, signed in Septemberdefines price stability as annual increases in the Consumers Price Index CPI of between 1 and 3 per cent on average over the medium term, with a focus on keeping future average inflation near the 2 percent target midpoint. RBNZ Rate Statement Period: Credit Card Spending Period: Shows a change in the total expenditure made via credit cards.

ECB Economic Bulletin Period: It reveals the statistical data that the ECB Governing Board evaluated when making the latest interest rate decision, and provides detailed analysis of current and future economic conditions from the bank's viewpoint.

The headline figure is expressed as the percentage change from the same month last year. CBI Industrial Order Expect CBI Industrial Order Expectations Period: Get code of Forex informer. A year ago, the EU lifted the sanctions imposed on President Alexander Lukashenko and other Belarusian officials.

We remain bullish looking to buy above Global benchmark Brent fell 11 cents or 0. However, the company said it was not sure if the deal could be closed in time to prevent the company from collapsing. The bidding group, led by Bain Capital and SK Hynix Inc. The package delivery service company predicts earnings Based on the minutes of the BOJ's April gathering released Wednesday, policymakers were more upbeat about exports and industrial production but still The dollar index versus a group of its peers was 0.

The greenback reached a one-month peak of Last year, the automaker said it would shift its Focus production to Mexico in But in the plan publicized yesterday, the Chicago Fed President Charles Evans said the U. However, markets were shocked that Argentina did not get an upgrade from the frontier market category where it has been stagnant in recent years.

Positions volume for Forex currency pairs

The greenback strengthened as New York Fed's William Dudley emphasized recent sluggish data won't likely hamper plans to keep increasing rates, denting the appeal for the yellow metal. US gold futures on Tuesday closed at Dallas Fed President Robert Kaplan said Tuesday the low yields imply markets anticipate degenerating growth ahead.

Although contented with current rates, he noted they have to be mindful about eliminating accommodation if the Before altering his view, the BOE head said he would want to observe how consumers, companies, and financial markets reacted to the reality of the United Kingdom's imminent departure from the European Union.

How News Affect Forex? The administrators and holders of the web resource do not warrant the accuracy of the information and shall not be liable for any damage directly or indirectly related to the content of the website.

It should be borne in mind that trading on Forex carries a high level of risk. Before deciding to trade on the Forex market, you should carefully consider losses that you may incur when trading online.

You should remember that prices for stocks, indexes, currencies, and futures on the MT5 official website may differ from real-time values. If you have decided to start earning money on Forex, having weighed the pros and cons, you can find a wide range of useful information including charts, quotes of financial instruments, trading signals, and tutorials on the web portal.

Improve your trading efficiency with information acquired from MT5. H4 M5 M15 M30 H1 D1 W1 MN. Never 10 sec 20 sec 30 sec 1 min 5 min 10 min. Cooperation Disclaimer Advertise with us About MT5.