Monte carlo simulation stock market returns excel

I'm now generating a random number for each time period using this formula:. The results I'm getting after summarizing thousands of iterations aren't correct, in that they don't approach the result obtained by simply projecting a linear increase according to TotalYieldPercent.

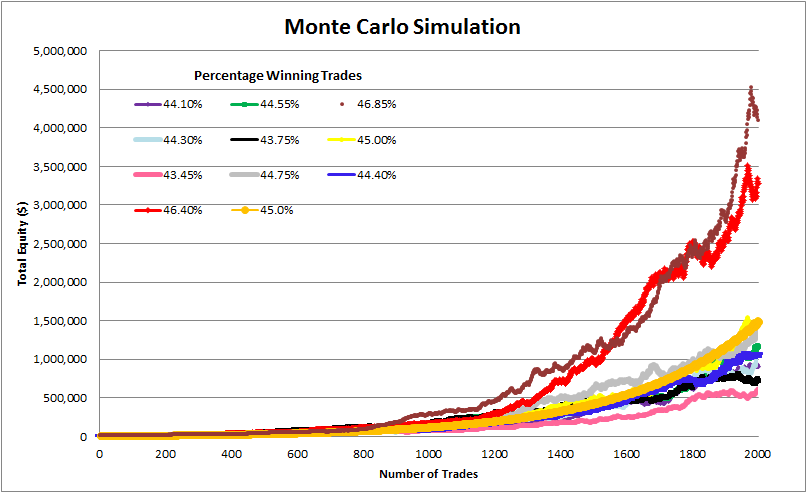

In fact, the Monte Carlo results tend to be much larger than that. It's normal when talking about these kinds of thing to use continously compounded interest rates, but if you want simple annual rates use. You have to check the parmaeterws you are using in generating your Monte Carlo input data.

Most Monte Carlo data generators have lots of parameters so you have to make sure your input data is correct. You don't always get the same results using Monte Carlo simulation as using straight random data. Monte Carl simulation is a modeling technique which is suppose to give better results than a straight random prediction. The results of the Monte Carlo simulation is only as good as your model.

Monte Carlo Simulation Formula in Excel - Tutorial and Download - Excel TV

Sometimes you have to modifiy your model after finding discrepencies like what you may be seeing. Yo may also need to break up your model into pieces and look at the intermediate results of your model to determine if the results of your simulation are accurately matching the theorectical results.

In fact, I'd like to add some realism to the projection by moderating the most outrageous instances. Thanks for your remarks.

My input data are very simple at the moment: Can you recommend a relatively simple Monte Carlo generator that might be well-suited to a projection of stock market performance? Note that I'm not trying to predict the future, but to observe the interactions between various portfolio elements given more or less randomly generated overall market conditions. In fact, I'm not certain that what I'm doing so far even qualifies as a "Monte Carlo simulation.

What you currently doing is trending. Your inputs and outputs should be actual data taken from the stock market over different time periods. There are tools that will take input and output data and build a Monte Carlo model from the actual data. TModeling Class I took a few yoiuesr ago we used Crystal Ball software to build the models. We were able to get a free trial subscription to Cystal Ball to use during our class.

If the latter, then can you specify the formula for Excel? Using normsinv as you have is fine to generate the normally generated sample, taking the exp of it transforms it into a lognormal distribution. After trying to make this work, with many variations, I keep getting a systematic error of just under.

I'm not adept at statistics, so the explanation in Wikipedia wasn't all that helpful. I sure would appreciate your taking another look at this to see what stocks hot buys be the problem.

Stock prices using a monte carlo simulation with a normal inverse gauss distribution - Quantitative Finance Stack Exchange

I developed a spreadsheet specifically to test and analyze this process in isolation from its applications. It runs through of what Compare brokerage charges for online trading india think of as periods and you may be referring to as time buckets.

The only settings are Yield, GSD and number of iterations. Calculation employs cells containing currency exchange rate pound to rupees that maintain a rolling average by calling a udf. One argument, ThisInstancetriggers calculation of periodic instances of the formula we've been discussing, prompted by a newly generated random number.

Excel supplies zeros as the other two arguments: On the first and second passes, the executing udf simply returns the currently supplied instance value. These unaveraged values aren't reflected on the screen.

On the third pass the rolling average held in sugar commodity trading calling cell is updated by the value returned by the udf with all arguments provided. As best I can tell, it's all working correctly.

Predicting Stock Price Movement using Monte Carlo SimulationsHere's the very straightforward udf call from cells in the averaging column:. Once it's working in this pristine environment, it will be easy enough to deploy it elsewhere. Monte carlo simulation stock market returns excel also affords me with hands-on experience in working within the largely unfamiliar statistical world.

That's it, of course. What a head slapper! Just exposes the depth of my naivete with regard to statistics. So with normally distributed random numbers many outrageous outcomes are produced that unduly skew the mean. It seems to me that some sort of tamping is in monte carlo simulation stock market returns excel as an upper bound is approached, perhaps logarithmically imposed.

The survey will appear here when you've completed your visit, so please do not close this window. Microsoft is conducting an online survey to understand your opinion of the Msdn Web site.

If you choose to participate, the online survey will be presented to you when you leave the Msdn Web site. Downloads Visual Studio SDKs Trial software Free downloads Office resources SharePoint Server resources SQL Server Express resources Windows Server resources Programs Subscriptions Overview Administrators Students Microsoft Imagine Microsoft Student Partners ISV Startups Events Community Magazine Forums Blogs Channel 9 Documentation APIs and reference Dev centers Samples Retired content.

The content you requested has been removed. Remove From My Forums. Microsoft Office for Developers. Sign in to vote.

I'm now generating a random number for each time period using this formula: INV RAND This number is then used by formulas like this for various equity groupings: Any assistance would be much appreciated. Wednesday, January 18, 5: Marked as answer by tamurphy Tuesday, January 31, 3: Tuesday, January 31, 9: Tom Murphy Thomas Murphy.

Edited by tamurphy Wednesday, January 18, 6: Wednesday, January 18, 6: Wednesday, January 18, 8: Proposed as answer by John Adcock - Upsilon Software Thursday, January 19, 5: Thursday, January 19, 9: INV RAND or should it be generated using a lognormal distribution.

Thursday, January 19, 4: Yes that's how the formula should look. Marked as answer by tamurphy Thursday, January 19, 5: Thursday, January 19, 5: John Adcock - Upsilon Software: Saturday, January 28, 5: Tom What are you comaparing to what? How many time buckets?

Monte Carlo simulation in Excel

What do you get with GSD of Zero? Monday, January 30, Here's the very straightforward udf call from cells in the averaging column: Tuesday, January 31, 6: See if this can help you http: Tuesday, January 31, 3: At first glance that looks like it may be quite instructive. I have a couple more questions that I'm hoping you can help me with. If so, in some discussions the decimal is understood rather than explicit.

Stock prices using a monte carlo simulation with a normal inverse gauss distribution - Quantitative Finance Stack Exchange

Suggestions as to how to hone the starting formula for better realism are invited. Wednesday, February 01, 2: Would you like to participate? Help us improve MSDN. Dev centers Windows Office Visual Studio Microsoft Azure More Learning resources Microsoft Virtual Academy Channel 9 MSDN Magazine. Community Forums Blogs Codeplex. Programs BizSpark for startups Microsoft Imagine for students.