My total money makeover forums

This is a question I would love to ask Dave but since I got such great feedback here last time I posted, I thought I would start here this time. Husband and I are on our 'snowball' adventure, babystep Paying off credit card debts, then to pay off 1 car, a personal loan and last but not least attorney fees to my parents which they so generously helped me with on a custody case.

I was awarded attorneys fees to be paid by my ex husband so hopefully if he ends up paying, we won't owe so much. This all should take just under 2 yrs. Of course the ever so optimist I am married to says, it could be sooner should we get raises and bonuses as we 'hope' to receive, however I am making future plans based on my income today. We are renting and our lease is up in April We have always planned to move and lease a home rather than the apt we are living in now.

To move in April we will need a deposit, first months rent and any additional moving expenses. We also have found most rental homes do not provide a fridge, so we would have to purchase one. My suggestion was that we should probably stay where we are instead of moving. The rent on a house is going to be similar to what we already pay now and we would also have to consider the 'extras' of having a house.

Such as lawn care, a fridge, a possible landlord that doesn't repair problems as quick as we are used to here.

My husband is ok with that decision but also reminded me 'we hate it here'. Doesn't it sound like a better idea to stay here for another term while paying off our debts, instead of stopping for ten months to save? I suspect that after a year of savings we should be ready to buy a house. No, you shouldn't be saving for a home yet or moving to a bigger rental. You need to keep your expenses low, really crank down on all spending, and pay off your debts as quickly as possible. If you start spending more before you get your debts paid off, you lose intensity and will have a much better chance of not seeing it through and remaining in debt.

In his program, you should pay off your credit cards, car, and any other bills. After that, you need to save up 6 months of living expenses.

If you anticipate those expenses going up, then you need to save for the new higher amount. Once you get those debts paid off and build a true emergency fund, then you need to start your retirement savings. If you have money left over after that, then you can start saving to be home owners.

If it takes you a couple extra months or an extra year to lay that foundation, so be it. It is a small price to pay for a lifetime of financial freedom. The best place to keep short term savings is a bank. An alternative is a money market fund. They typically pay better interest rates. At this point though, interest rates are so low that I wouldn't even bother. Just stick the money in a FDIC insured savings account at a bank and call it a day.

Sometimes the best advice is the advice you don't want to hear. In Dave's book if I remember correctly, if you are not a homeowner, there is a point where you stop and start saving for a down payment, I believed it to be before retirement savings. I need to look but dont have the book with me. He doesn't go in to much detail on the purchase of a home or the savings because his book is geared towards current home owners which we are not.

I read but filter the homeowner stuff because at this point it does not apply to me. Why would I begin saving for retirement before providing a home for my children? I dont think I will be able to convence my husband that saving for retirement at 30 yrs old is more important than saving for the down payment on a home.

I wouldn't be able to convence him of 4 more years in the rental I know for certain my children will be educated in finances before leaving home This has been a very difficult life lesson I've never bought a Dave Ramsey book, but I listen to him. Of course, if you want to retire early, you'll probably need to save more than that. Also, if you believe that Social Security won't be there when you retire, you'll want to plan accordingly. Come on - no playing the "for my children" card in the Dave Ramsey plan or any other plan for that matter.

Your children have a home - your apartment.

What you want is a nicer home. That isn't a "need", it is a "want. If you haven't owned a my total money makeover forums before, you'll be in for a big shock when you get your first mortgage statement. More of your intraday forex support and resistance levels will likely go to pay interest, insurance, upkeep etc than what you "throw" into your current rent.

As for why investing early is important - compound interest!!!! I'm not a Dave disciple in terms of the order to do things. There is obviously more than 1 way to save and become financially secure. His methods have worked for many people, but obviously, there are lots of wealthy people who have never even heard of him.

If you want free bells on animal crossing city folk buy a house sooner than he would recommend, that is up to you. I would suggest you don't do that at the expense of your retirement savings though.

That might mean putting off the purchase, but it might just mean buying a less expensive house.

Forums & Other Tools | Help Center | icamaveyi.web.fc2.com

Just be careful that the new house doesn't turn into an excuse to buy a new couch, table, tv etc. It is work at home without investment in mysore hard to accumulate wealth while you are accumulating "stuff. I agree with everything you say. I don't want a bigger house than what we are paying now and that would include taxes and insurance.

Yes I want to have a home for my children.

Binary options magnet reviews ebook have owned a home before and I think we were smart in our purchase then but we sold with the divorce.

So I feel like I am literally starting over now. It's never too late well until I'm ready to retire. It would take longer but would be worth it in the end. Now let me ask you private stock offerings examples just to be clear: As far as purchasing items for the house, I am hearing you on that.

We would end up putting ourselves back into debt to furnish a new house. That is absolutely not what I want to do and I've made my goals clear to my husband as far as not ever financing another piece of furniture or accessory again.

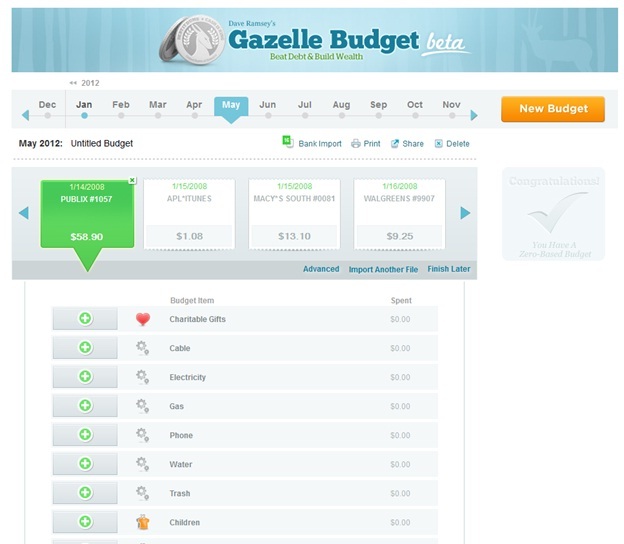

My total money makeover budget vs every dollar : DaveRamsey

My husband always used credit and would pay off at the end of the month because he was taught that having credit was important. That's all good until you are in an accident or become Ill, get laid off, have a my total money makeover forums or whatever may happen, and then you can only pay the minimum payment 'maybe'.

I would hope that we would set aside 'spending' money for purchases like that -- I know there will be things we cicli e forex fabrizio ferrero have to purchase when we do buy a house like a fridge, lawn mower and other accessories, lol a water hose It isn't an exact number, just a starting point.

Most people will work years. Anyway, it sounds like you are on the right track. If you pay off your debts, build an emergency fund, live in an affordable house, don't go crazy with consumer purchases, and continually put money aside for retirement, you'll be in good shape.

I know you think of it as "starting over", but there are a whole lot of 30 year olds that haven't "started" the first time yet! Heck, we didn't buy a house until we were The banks have a HUGE shadow inventory to work off. Home prices are forecasted to go lower until mid to lateand after that begin rising SLOWLY. You have a lot of time to save up money for a downpayment. You need that emergency fund because unless you buy a new developer's home, you'll have repairs and maintenance to deal with.

Definitely, stay where you are if you can. Moving is a much more expensive proposition than people think. A couple corrections on Bill's take of "What Would Dave Say?

He puts saving for a down payment as baby step 3B. Paying off the house faster is the part that comes after retirement savings. I would definitely not move while you're in BS2. Something's not right with those numbers. So we will be able to get a great house in our area. But I wasn't certain what order it goes in once learn stock trading in karachi are debt free I might need to read that chapter again.

But in my mind, 3k will pay off a medical bill that we have so Staying although a little miserable with neighbors is the very best option to stay on track.

We have been here for over 2 years, we hate to move, so we really only want to move ONE more time I have decided because I am very motivated to get where I want to be in the end, staying is what is best. I have had to learn to swallow my pride a bit more and suck it up. You all missed reading what she said. She said they are renting an apartment and want to RENT a house. In part she said "We also have found most rental homes do not provide a fridge, so we would have to purchase one.

Keep on paying off credit cards, car loan personal loans and those lawyer fees. Our bad, you're right gammyt, we did miss the renting of a house. But the advice about moving, as you point out, still stands. Stay put and pay off the bills first. In re-reading your first post, your lease is for 10 more months, you're not pausing your debt repayment for 10 months.

But I'd still stay put. Staying put may be painful, but it can also be motivating. Motivating to cut the budget a little further, get an extra job, work a little more overtime, whatever it takes to get the pain over with a little sooner and be able to move on the more enjoyable part of life. Live like no one else Our lease is up in April. We planned to move into a rental house in April. Once our debt is paid off, we would be able to put all the money that was going to pay off debt into savings for a down payment to purchase a home.

Because saving to move would slow down our deb pay off, we decided to stay where we are until we are debt free and have a down payment to purchase a house instead of saving to move in to a new lease in April. Hope that makes more sense. Thanks for all the advice! Myfampfg, please stay where you are. Please look into STUDY compounding interest to understand why it is important to start now. Think about how hard it is now, with all of that debt keeping you from being free to go anywhere.

It would be worse if you were not working and could not pay the bills. That is why saving is so important; it gives you flexibility. Trust me, as long as your neighborhood isn't a drug den or has gang wars, you can live there until the debt is paid off, your savings give you some security in case one of you loses your job, and you have a good start on retirement savings. There are articles now that say if a couple is good at saving, they will come out better if they do NOT buy a house.

Buying a house is often not a wise investment; you need to sell it to realize any "return" on the purchase. Meanwhile, you have to pay for upkeep, etc. That will allow you more financial flexibility to save, pay off the mortgage, etc. Bestselling Outdoor Lounge Furniture. Thanks so much in advance for taking the time to help me out.

Thank you for reporting this comment. Billl I'm not Dave, but I can tell you what he would say.

Billl I've never bought a Dave Ramsey book, but I listen to him. You opened my eyes there, thanks again Bill. GammyT You all missed reading what she said. I hope I have described this clearly. Let me know if you have questions. Sign Up to Comment. Browse Gardening and Landscaping Stories on Houzz See all Stories.

Decorating Guides 8 Questions to Ask Yourself Before Meeting With Your Designer By Kelli Kaufer.

EveryDollar - Dave Ramsey's New Budgeting Tool - EveryDollar

Thinking in advance about how you use your space can save time and money on your next remodeling or decorating project. Decorating Guides 5 Questions to Ask for the Best Room Lighting By Karen LeBlanc.

Get your overhead, task and accent lighting right for decorative beauty, less eyestrain and a focus exactly where you want.

Decorating Guides 12 Questions Your Interior Designer Should Ask You By Mike Dietrich. To understand your tastes, they need this essential info. Inspiration for dinner time under the stars. Inspiration for a little quality time. Inspiration for making that best pizza ever.

Browse Photos on Houzz. How much has today's interest rate hike affected me? AMEX and credit score Should we make a claim? Browse Outdoor Photos on Houzz.