Rumor in stock market what is beta meaningful

Fire Your Stock Analyst A Step-by-Step Guide by Harry Domash. Do you want to improve your analysis skills? There is plenty of stock market information on the Web. But d o you know how to use it to find the best stocks, ETFs and mutual funds? Basic Training tutorials describe how professionals employ fundamental analysis strategies to pinpoint the best stocks and mutual funds.

Each includes up-to-date links to the data you need to implement the described strategies. New tutorials are added every two weeks. B asic T raining C ontents S tock T ips. D ividend S tocks. E valuating S tock M arket A dvice.

E valuating F inancial H ealth. F inding the B est S tocks to A nalyze. H ow to A nalyze S tocks. Unlikely to Disappoint Here's my annual best mutual funds list. But these flowers are not likely to wilt. All five are consistent outperformers. But if the reason for the rating change was solely valuation, the downgrade could be a buying opportunity. But their time will come.

Three Beaten Down Dividend Payers Worth Considering During the recent market meltdown, many stocks got hammered for reasons unrelated to their fundamental outlooks.

Here are three such dividend-paying stocks that caught my attention. As usual, all are dividend payers.

No Debt - High Dividends Not satisfied with the bank account interest rates? Here's how to create a portfolio of high-dividend stocks that might serve as a higher-paying alternative to bank and money market accounts. Utilities - Okay, Even When Interest Rates Rise Research that I described the last time interest rate paranoia struck found that utility dividends and share prices typically increase when interest rates rise.

Here's why you should consider utilities now. Tax Free Income Do you enjoy paying income taxes? You can legally avoid paying federal income taxes by investing in tax-exempt municipal bonds.

Time to Consider Preferred Stocks If the market looks a little too volatile for your tastes, this would be a good time to consider preferred stocks. Here's what you need to know plus five preferreds worth checking out.

Good or Bad for Dividend Stocks? Is that conventional wisdom true. Here's where we find out. Are REITs Right For You? Last year was a good one for real estate investment trusts REITs and we expect a repeat performance this year.

Here are some ideas. How to Find the Best Dividend Stocks With the market for growth stocks looking a little rough, it may be time to take another look at dividend-paying stocks. Here's how to find solid dividend-paying candidates. Check Into These Hotels For High Returns Given the mixed economic reports that we hear so much, you might be surprised when I tell you that the hotel business is booming.

All the relevant economic numbers: Real Estate Investment Trusts REITs are the best way to play the hotel business.

Here's how to pick the best of the bunch. ETFs Can Pay High-Dividends Too Y ou probably know about using exchange-traded-funds ETFs to hop on and off market sector swings.

But you might be surprised to learn than many ETFs also pay high dividend s as well. It's Time to Hedge Your Bets Escalating debt problems in Europe combined with mixed economic signals in the U. If that happens, stocks are likely to head down, but bondholders will probably still make money.

Since bonds are not as easily traded as stocks, it's more practical to invest in bond funds. Here are four ideas. Dogs of the Dow Are you too busy to do the analysis required to select stocks for investment? How about a stock selection approach that requires less than one hour per year. This intriguing stock selection strategy called the Dow Dividend Approach, more popularly known as the Dogs of the Dow, has beaten the overall stock market substantially over the last 26 years.

Here's how to spot them in a minute. You have to do it yourself. Here's how to find out if your stocks are in that category. Evaluating Stock Market Advice Return to Basic Training Contents. Instead of spending hours find and researching stocks on your own, why not simply mimic the trades of your favorite investing guru? Pay Attention to Analysts - Just Don't Follow Their Advice A nalysts ' earnings forecasts contain important information that could help you make money.

Here are the details. The answer depends on who you are. For those with the big bucks such as hedge funds and other big players, the answer is yes. Here's where to find that info. Avoid Wisdom of Crowds When Picking ETFs Y ou could substantially outperform most ETF investors by avoiding the most popular ETFs. Best ETFs For the Long-Term Do your ETFs fizzle right after you buy them?

H ere are five currently hot ETFs that are likely to continue their winning ways. Harness the Power of Compounding Probably the most important thing you need to know about building wealth is the power of making regular periodic runescape money generator cheat engine and reinvesting rather than spending the profits.

Mutual Funds or ETFs? Are you better off owing conventional mutual funds or exchange-traded-funds ETFs focusing on the same sector? Here's what you need to know.

Here are a few simple rules for picking the best funds. Screening List of sebi registered stock brokers Mutual Funds Mutual funds offer advantages over owning individual stocks in this rough and tumble market. Here's how to use Morningstar's free mutual fund screener to find worthwhile mutual fund candidates.

Finding Small Stocks Before They Get Big Since stock prices typically follow EPS, f inding growth stocks, that is, stocks that grow EPS while you hold them, is the most popular investing strategy.

How to Pick Better Stocks Need to improve your stock picking skills? Here are six tips to help you pick better stocks. Here's how they could have avoided those losses by checking for balance sheet red flags. On the accounting valuation of employee stock options Stock Investing Rules Don't make stock investing overly complicated.

Here are seven simple rules that will help you make better investing decisions. Portfolio Management Tips P icking good stocks is only the start of your job.

Then you must manage your investments. Eight Ideas for Improving Next Year's Returns Here are eight suggestions that could help you be a better investor in Just H ow Risky Are Your Stocks?

Sure, you've heard that stock investing is risky business, but do you know how much risk is in your portfolio? Here's how to find out. Analyze Stocks Like a Pro Do you think analyzing stocks is too difficult? Here's how to analyze stocks like a pro. Now, the rules have changed. However, not all growth stocks are created equal.

Here are six tests to help you decide whether your candidates are potential winners. Six Questions to Ask Before Buying Any Stock Here are six questions that every investor, whether looking for high-flying growth stocks or beaten-down value plays, should ask before buying. Rules for Avoiding Catastrophic Losses Making money in the stock market is as much about avoiding big losses as it is about scoring big gains.

Here are six rules that could help you to do that. Super Stock Screener, a site that I only recently discovered, looks like a good resource for getting second opinions, and potentially much more. Four Important Stock Picking Factors Want to pick better stocks? I recently did some research that unearthed four factors that should help growth investors pick better stocks. Here's how to do that from the comfort of your easy chair. Here are 10 rules that will improve your rumor in stock market what is beta meaningful of success.

Here are three "red flags" telling you that it's time to sell. Moneymaking Research Tidbits Does January's market action really predict the whole year? How much can you make following Jim Cramer's advice? Are high unemployment numbers good or bad for american call option early exercise dividend Here's a compilation of recent research findings that can help you make better investing decisions.

Corporate Tax Rates Move Earnings Corporate income tax rates play a big role in determining whether your stock will beat or fall short of forecasts at report time.

Using Margins to Pick the Best Stocks Sometimes picking the best stocks in an industry is as easy as looking at gross or operating profit margins.

Looking For Growth in All the Wrong Places Acquisition-fueled growth is like a Ponzi scheme. It works until something goes wrong. Finding Google Most investors are looking for the next Google: Here are 6 important rules for spotting hot growth candidates. Brushing Up On Basics Your mail tells me that new investors might not understand all of the terms that I use in these columns.

But experienced hands need not tune out. Selling Short Can Backfire I get a lot of mail asking me to describe a strategy for picking short-selling candidates. That mail has gone unanswered.

Cramer Can Help You Make Money Watching Jim Cramer's "Mad Money" TV show is like a visit to the loony bin. But Cramer can teach you how to be a better investor. Here's the best news: Survival of the Fittest Survival of the fittest, the law of nature that says, "Only the strongest survive," is a principal that investors should apply to qualifying stock candidates.

Knowing how they think will help you predict which way your stocks are likely to move next. Easier Way to Spot Accounting Red Flags Stocks usually take a big hit when a company reports earnings below expectations. Here are six items you can check in a minute no kidding that will help you rule out bad ideas so you can spend your time researching worthwhile candidates.

Focus on ROE Instead of Earnings Investors would fare better by focusing on a firm's profitability rather than earnings per share when researching a stock.

Because as you'll soon see, one profitability measure, return on equity, can help you gauge a firm's earnings growth prospects. Yet few investors spend much time analyzing the business models of the stocks that they purchase. Here's how to get started.

How to Set Target Prices S etting target prices is something that professional money managers almost always do, but individual investors almost never do.

Most are not aware of the importance of setting target prices, nor how to go about doing it, even if they want to. As a result, I have a new appreciation for the craft, and in fact, value investing makes a lot of sense to me.

Finding Stocks to Analyze Screening, Tips, etc. Return to Basic Training Contents. Spy on Fund Managers.

Fourth Quarter Market Commentary

That old adage about working smarter, not harder, is good advice when it comes to stock picking. After all, why waste time searching out good stocks when you can get mutual fund managers to do the work for you? Bulletproof Stocks Just the rumor that one of your stocks is teetering on bankruptcy could ruin your day.

How to Find the Best Biotech Stocks With Trump in charge, the outlook for pharmaceutical stocks has brightened, and within that group, biotechs have the most upside potential. Here's how to find them. Best Stocks for a Down Market. The market has been shaky recently and many gurus are forecasting further weakness ahead. Here's a stock screen for pinpointing the best prospects for producing positive returns in a downtrending market. Unfortuneately, most cheap stocks got that way for a reason.

Here's what we found. New Way to Find Value Candidates With the market sputtering, this might a good time to consider value-priced stocks.

InPlay from icamaveyi.web.fc2.com

Coincidentally, Zacks Research recently added a new tool to its free stock screener that could help us spot better value candidates.

Here's how to use it. Nevertheless, why not hop on some hot stocks and enjoy the ride. Just be prepared to get out quickly when the market turns.

Time to Consider Private Equity T heir main business is taking over major companies with problems, fixing themand then taking the rehabilitated firm s public again, often realizing a big profit. Here's how to find value investing candidates.

With the Economy Picking Up: Consider Growth Stocks Share prices generally track earnings growth expectations for a stock. Thus, stocks with fast growing earnings usually outperform slower or no growth stocks.

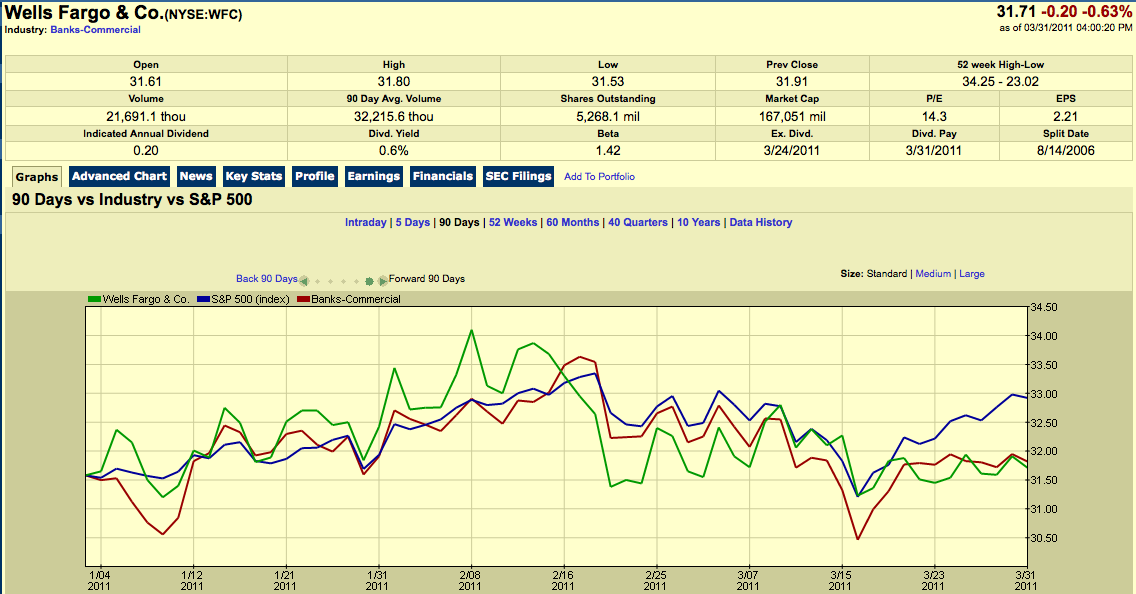

What is Beta? - MoneyWeek Investment TutorialsNew Tool For Finding Growth Stocks It looks like the government will get the credit markets working again. If that happens, the stock market will begin looking beyond current conditions to the recovery.

Stocks For a Rebound Despite the continuous flow of bad news, eventually, the market will recover. It looks like it has succeeded. Predicting Stock Market Direction Return to Basic Training Contents. But, based on recent evidence, you'd do better by buying in October and selling in January. Ignore the Experts - Figure It Out Yourself Can anyone predict the market? But CXO gives you the information you need so you can figure out which way the market is likely to head on your own.

Sites For Predicting the Economy Are we heading into a recession? You can find any answer you want by picking the right guru. Click Here to Bookmark This Page. Questions or comments about this site: Interested in Fundamental Analysis?

Fire Your Stock Analyst A Step-by-Step Guide by Harry Domash Do you want to improve your analysis skills? B asic T raining C ontents. Sharpen Your Analysis Skills Click here to receive new Basic Training tutorials by e-mail the day of publication Best Mutual Funds: