Seasonal futures trading strategies

I will test this on the cash market going back to The number of shares to buy will be adjusted based upon a fixed amount of risk.

Charting Your Futures - Commodity Brokers -Free Commodity Futures Charts, managed commodity accounts,electronic order entry

As this is a simple market study no slippage or commissions were taken into account. The EasyLanguage code looks like this: The following assumptions were made: From here we can plug into the input values the buy month November and sell month May. Doing this we generate the following equity graph: It sure looks like these months have a long bias as those are some nice results.

What would the equity curve look like if we reverse the BuyMonth and SellMonth? Below is the equity curve for this inverted system. The early years of to about the equity curve went lower and lower. Then it started climbing reaching an equity peak of During this period, the strategy was producing positive results. That was the year we had the massive one day market crash on October 19th known as Black Monday.

Since that event the behavior of market participants has been altered. This is not unlike the radical market changes which occurred after the market peek where much of the trending characteristics of the major markets were replaced by mean reversion tendencies.

So far the basic seasonality study looks interesting. However, keep in mind that we do not have any stops in place. Nor do we have any entry filter that would prevent us from opening a trade during a bear market. If the market is falling strongly when our BuyMonth rolls around we may not wish to purchase right away.

Frank Denneman

Likewise, we have no exit filter to prevent us from exiting when the market may be on a strong rise during the month of May. This filter will be used to prevent us from immediately buying into a falling market or selling into a rising market. For example, if our SellMonth of May rolls around and the market happens to be rising trading above the period SMA , we do not sell just yet.

We wait until unit price closes below the short-term SMA. The same idea is applied to the buying side, but reversed. We will not go long until price closed above the short-term SMA. The MinorTrendLen variable is actually an input value which holds the look-back period to be used in the SMA calculation. You will notice there is an additional check to see if the look-back period is zero. If you enter zero for the look-back period, the code will always set our BuyFlag and SellFlag to true.

This effectively disables our short-term market filter. This is a handy way to enable and disable filters from the system inputs. Below is the performance of both our Baseline system and the system with our SMA filter: We increased the net profit, profit factor, average profit per trade, annual rate of return, and the expectancy score.

The max intraday drawdown fell as well. Overall it looks like the SMA filter adds value. A standard MACD filter is a well known indicator that may help with timing.

Overall, it does not appear to be better than our SMA filter. For our final filter I will try the RSI indicator with its default loopback period of Again, like the MACD calculation, I want price moving in our direction so I want the RSI calculation to be above zero when opening a position and below zero when closing a position. The RSI filter performed better than the MACD filter. Yet, the net profit factor is lowerand the Expectancy Score is lower.

In the end it does appear applying a SMA filter or an RSI filter can improve the baseline results.

Both filters are rather simple to implement and were tested for this article with their default values. You of course could take this much further. It even appears to work well on some stocks. Keep in mind this market study did not utilize any market stops. How can this study be used? With a little work an automated trading system could be built from this study.

Another use would be to apply this study as a filter for trading other systems. This seasonality filter could be applied to both automated trading systems or even discretionary trading.

It may not be much help for intraday trading, but it may be worth testing. Hope you found this study helpful. Seasonal Strategy TradeStation ELD Seasonality Strategy WorkSpace TradeStation TWS Seasonal Strategy Text File. Notify me of followup comments via e-mail. You can also subscribe without commenting.

Download this free guide on how to stop curve fitting. Following these four simple steps can improve your trading dramatically! About Us Blog Contact Free Easylanguage State of U. Markets Live Trading Results. Recent Posts Seasonality in the Bond Market? Using Metals to Trade Bonds MCVI Indicator and Strategy on Daily Charts Market Seasonality Study Open Up!

Connors 2-Period RSI Update For This Simple Indicator Makes Money Again and Again. The Most Important Performance Measure. Improving The Simple Gap Strategy, Part 1.

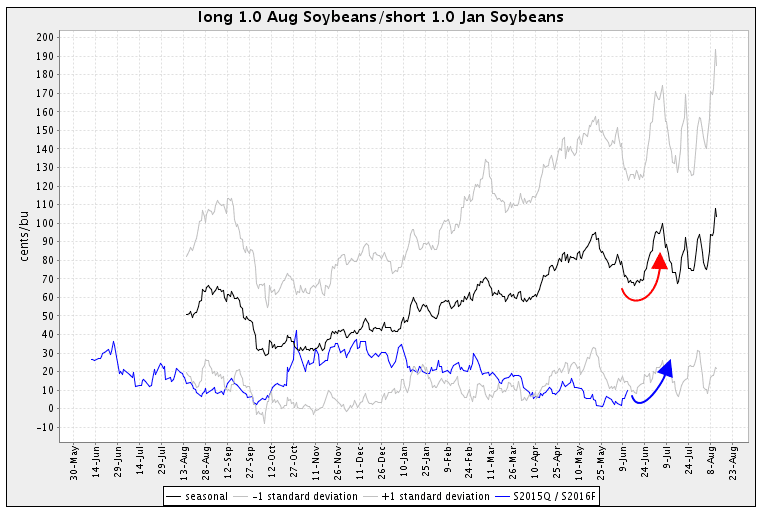

Why to trade seasonality? | icamaveyi.web.fc2.com - SA

A Different Kind of System…. Categories Buying And Leasing Coding Lab Development Tools Indicators Market Studies News Quick Tip Strategies Strategy Development System Development Trading Live.

Seasonality trade closed on May 18, Click image for larger view. Previous Post Open Up! Next Post MCVI Indicator and Strategy on Daily Charts. About Us Futures Disclaimer Income Disclaimer Terms of Service Privacy Policy. Learn To STOP Curve Fitting!