Unrealized foreign exchange gain loss canada

Forum Today's Posts FAQ Community Member List Forum Actions Mark Forums Read Quick Links View Forum Leaders What's New? Forum Money Topics Taxation Accounting for Unrealized Foreign Exchange Gains. Results 1 to 5 of 5. Accounting for Unrealized Foreign Exchange Gains.

Thread Tools Show Printable Version Subscribe to this Thread… Display Linear Mode Switch to Hybrid Mode Switch to Threaded Mode. Ann View Profile View Forum Posts. Accounting for Unrealized Foreign Exchange Gains How does a Canadian corporation account for unrealized foreign exchange gains and losses?

They calculate the Canadian dollar equivalent, do their bookkeeping in Canadian dollars and pay taxes accordingly. Each year the foreign exchange rate changes, does the company pay tax on the foreign exchange gain?

Are there any books or articles that explain this scenario?

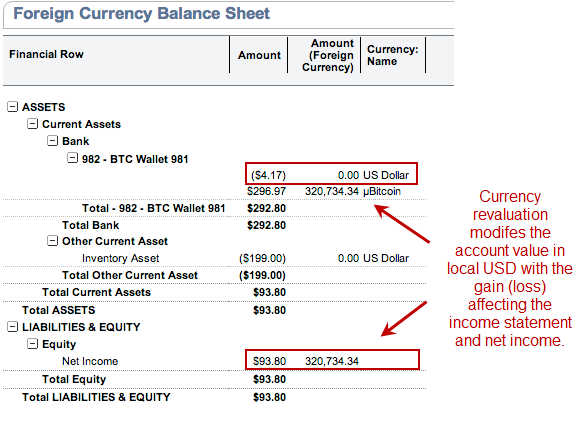

Recording Unrealized Currency Gains and Losses / How To / Knowledge Base - AccountEdge Support

It's probably Accounting Thanks for your kind help. You can reverse the entry on Jan 1 to bring the bank account balance back in line.

You should use bank of Canada rates. So if you buy product for resale and pay US but then sell in Cdn. You are not getting a true cost of goods picture.

KPMG International | KPMG | CA

Originally Posted by Ann. Last edited by domelight; at Most tax jurisdictions in the world say that tax is only payable on realized gains. This will bring the Balance Sheet into balance. All times are GMT The time now is