Bollinger bands and elliott waves correlation

You should not be afraid of this apparently advanced trading topic, Elliott Waves. It is very easy to learn and understand. This information can be easily found over the Internet. That is why this article was written. Elliott Wave Theory helps you to understand the market movements and trends much better. At least, they have to know the waves and the strongest part of the price movement, either when the price is trending, or when it is ranging.

Yes, it is possible, but only when you wait for the too strong trade setups if you want to go against the trend. It is not as complicated as you can see on many websites.

Some people are used to make the things too complicated, but simplicity is the first thing in everything we want to do. Elliott Wave Theory in Forex Trading to Follow Trends. As you can see on all the price charts, the price never goes up or down directly and without any noise or ups and downs at the middle of the way. For example, when it starts going up, a few or few bullish candlesticks form, but then it stops going up, forms a few bearish candlesticks, or moves sideways for a while, and then starts going up again.

These ups and downs are called waves.

When markets start trending, the movements and the waves that form in trends, can be seen clearly in most cases. In spite of this, they still exist, but in a much smaller scale. Usually the movements start with a buy signal which can be strong sometimes. Usually after the first upward movement which can be strong, there is a short down movement which is called Wave 2. Sometimes it becomes impossible to distinguish the waves and differentiate them from each other.

In spite of this, you can still under such a condition. I will tell you how. After Wave 2, another upward movement will be started which is usually the biggest wave in an uptrend.

That is where most professional traders enter to take the maximum advantage of the uptrend. This important movement is called Wave 3. Wave 4 is a small bearish movement like Wave 2.

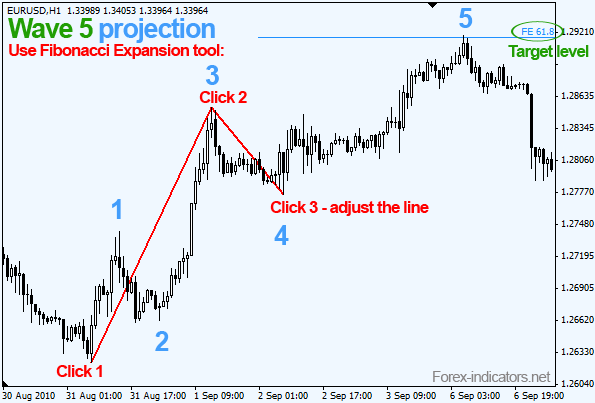

Wave 5 is another upward movement which is not that strong and is usually smaller than Wave 1. However, sometimes Wave 5 becomes too long and strong when the trend is too strong. We will talk about Waves 3 and 5 more, later in this article. That is the time that bears may take the control and the uptrend may reverse.

However, a consolidation forms and the price goes sideways when bulls are serious not to give the full control to bears but are exhausted at the same time.

The wave that forms after wave 5, is called Wave A.

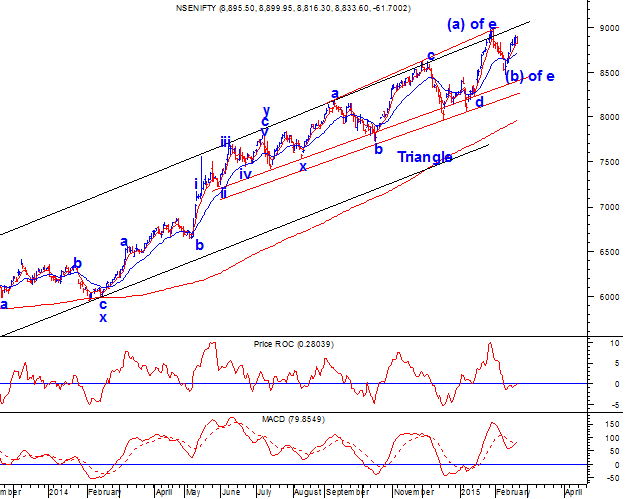

Live Analysis with Elliott WaveThis wave is a bearish wave which is not usually strong, specially when bulls are really strong. When the uptrend is too strong, then Wave A is a small bearish movement that can be the beginning of the formation of a consolidation like Flag or Triangle, or the beginning of a sideways movement.

After Wave A, another upward movement appears which is known as Wave B. This wave is usually the shortest wave. Wave C which is the last bearish movement, is usually the biggest downward movement.

It is the good chance for those who like to go against the uptrend. However, this wave is long enough only when bulls are not too strong and serious, otherwise it can be a short bearish movement that will reverse after a new buy signal formed by candlesticks. That last three waves A, B and C can be formed when the market is noisy and choppy, in the way that it sometimes becomes hard to distinguish Wave A and the next two waves.

Having Bollinger Bands can be a big help in this case too. After Wave C, another set or cycle of Elliott Waves will be started from the beginning wave 1. The waves length can be different under the different markets conditions.

When bulls are stronger, the bullish waves are longer, and when bears are stronger, the bearish waves will be longer:. Two Cycles of Elliot Waves. When bears take the control, the bearish waves A, B and C become longer. On the above chart, the first cycle the yellow zone was more bullish, and so the bullish waves were longer.

The second cycle the green zone was bullish too, but bears were stronger and bulls were getting more exhausted compared to the first cycle. Therefore, the bearish waves are longer on the second cycle. Elliott Waves On A Too Strong Bear Market. When a party takes the control very strongly, it becomes too hard and sometimes impossible to distinguish the waves.

It is possible that the waves I am showing you on the above chart are marked by me incorrectly, but there is no other way to mark them when the trend is too strong. For example, nobody can say whether the small upward movement that I have marked as Wave 4, is really Wave 4. When fear takes the control, the price collapses very strongly and the small bullish waves get lost under the bears feet! A Too Strong Bear Market.

When one of the strong waves is forming on a longer time frame , a cycle is in progress on a smaller scale on a shorter time frame. For example, when Wave 4 is forming on the above chart which is weekly, several different cycles are forming on a shorter time frames. Each of these cycles can be in different stages.

Small Cycles in Big Cycles On The Same Time Frame. Wave 1 is usually started when a strong trade setup forms by candlesticks. A too strong trade setup which is usually the start point of Wave 1, can be the beginning of a strong trend. Therefore, when a too strong trade setup forms on a sideways or exhausted market, it can be known as the beginning of a new cycle.

When you take a too strong candlestick signal on an exhausted and sideways market, there is a higher chance to enter the market at the beginning of Wave 1. Although it is sometimes impossible to identify the waves properly and correctly, you lower the risk of going against the strong waves, when you take the too strong setups on the exhausted and sideways markets.

The question is how do they do it? First, they wait for Wave 1 and 2 to form.

This assures them that a party has completely taken the market control. That is why they say trading is about buying high and selling higher, because first you have to wait for the price to go up. Then, you enter when bulls already have the control.

So, you buy high, hold, and sell higher. It is the same with going short. Just the direction is opposite. When trend is too strong, Wave 5 can also be as long and strong as Wave 3. You can enter the market at the beginning or middle of Wave 5 if a too strong continuation signal forms. Support Level Breakout While Wave 3 Is Ongoing. Some professional traders use other tools or indicators to track the formation of Wave 3. For example, a 50 Simple Moving Average sometimes can be a big help, specially when the trend, and so Wave 3, are supposed to be too strong.

Similarly, when it does the same when Wave 4 is forming, and then the price goes against this wave, it means Wave 5 is started which can be too strong also on the too strong trends. Those who miss the trends and all the continuation signals to join the trend, have to wait for the reversal signals. Also, those who are already in while a trend is forming, have to be careful to get out on time, not to lose the profit they have made.

On the other hand, they have to know how to maximize their profit and not to get out too early. When a strong trend is formed on the chart, the first strong reversal signal is the beginning of Wave A which is usually short. So, if you take this reversal signal, chances are it goes against you very fast and hits your stop loss. We ignore these setups even when they look too strong, because they are usually the beginning of Wave A that will reverse very soon.

Sometimes when the trend is too strong, Wave A is too small to be seen. Its movement can be seen on the shorter time frames, but not on the same time frame that the trend is ongoing. Wave A Reversal Signal That Has To Be Ignored. After Wave A, Wave B starts forming which is agreeable to the trend direction, but usually it is not strong enough also and closes around the same level that Wave A was opened.

They can be ended to a complete reversal which is Wave C. So, if you want to take the reversal setups and go against the trend, first you have to wait for Wave A and B to form.

Bollinger Bands in Forex Trading

Then you enter the market when Wave C starts forming:. Wave C Reversal Signal That Can Be Taken Sometimes. Sometimes you think you are at the beginning of Wave A, B or C, whereas the trend is too strong, and so, Waves 1, and 3 have been too long and even Wave 5 is not completely yet.

Going against the trend under such a condition can be too risky. The below chart shows that most probably the market has not started the Wave 5 yet. Still we have to wait to make sure that whether the uptrend will be continued or will be reversed.

If it moves sideways and forms a consolidation, then starts going up again, it mean a new cycle is started and the uptrend will be continued.

Then let me give you a simple formula: Which Reversal Signal Is Safer To Take? If you learn how to do that, you can even follow the too strong and unexpected movements, because these movements follow the Elliott Waves and strong setups on the long time frames. The below chart is one of the examples. I think you remember that trade setup. Taking The Too Strong Candlestick Signals At The Right Place Right Time!

Knowing the Elliott Waves is a big help to 1 increase your success rate and 2 have bigger gains. But, to be a consistently profitable trader, it is not a must to know the waves in details. You can avoid taking the reversal trade setups and signals, even when they are too strong, when the trend is still strong and probably is forming the strong waves like 3 and 5.

You can go for the too strong reversal trade setups when they are placed in a position that they are probably at the initiation of Wave C. If you follow the above tips, you can trade, make profit consistently, and control your risks properly. Thank You Chris for this wonderful article. May be my question will look stupid I am a novice trader , but would it be easier to see these waves if someone uses Heikin Ashi charts on the long time frames?

But it is good to follow the long waves. It seems it is at the end of the Wave A on the monthly chart. Therefore, it will probably start the Wave B which means it can go down once again. The next buy signal it forms will be a great chance to go long above the support levels on the monthly time frame, because it will be the beginning of Wave C.

Thank you so much Chris! Its all look so much simpler now and less troubling.

Do you think, that the wave number five is being formed right now? The first wave would be the long uptrend, then 2 is the long consolidation, then 3rd would be the movement after resistance breakout, then 4th is the downwards movement after the strong signal and 5th after bounce of the support which worked as a resistance for a long time.

If so, the immediate resistance line could work as a reversal and beginning of the wave A, unless bulls break through that, make a new high, and then create the reversal wave. I hope its clear? If my way of thinking is correct, then it looks like I entered the wave number 5. Here is the chart! Of course, maybe some traders say we are wrong, but that is something that looks obvious to us. Not all Traders agree on the waves and there are always some traders who think differently.

Wonderful piece of information here. Beautifully constructed and easy to understand article. Everyday another piece of the puzzle comes together and I can understand the market more and more. Thank you kindly, Chris.

Especially on how you combine it to our trading plan. Given the above explanation, no wonder that some traders combine Elliot Wave with Fibo to predict the target point. Thanks for this Elliot Waves article. You have taught us different trading systems, which is good in my opinion. It gives us choices as individuals with different preferences to study and concentrate on what we feel comfortable with. Bankers almost use the same method as we do. They also use and 50 moving averages to follow the trends better.

It is explained here: Until then may I ask you if you have taken the trade setup formed by the I think the Yes, it more looks like the beginning of wave 3. In our trading system, differentiating a trend from exhaustion or consolidation has been my Achilles heel. This article so clearly explains why WHERE the setup occurs matters so much.

Entry Timing Technique Using Bollinger Bands and Elliott Wave Oscillator | Elliott Wave Stock Market

Thanks Chris for the great article i was waiting anxiously, chart AUDCHF weekly 3rd wave cannot be shortest of wave 1 and wave 5, as per EW principles probably wave 5 is still wave 3. When it comes to the basic wave formation that most people are only taught then you are correct.

As long as we get the abc correct we can benefit from it when we incorporate candlestick patterns. It is clear that to be able to teach simply , you have to learn the difficult part, use it then simplify it. This in my opinion is the best article so far as it explains a complex topic simply. You are a master not only in forex but in the art of teaching. Perhaps the solution is to only draw waves on the weekly time frames to eliminate the noise and subjectivity.

Like all the other systems, indicators and…, Elliot Waves also work better on the longer time frames. It is much easier to locate the waves on the weekly and monthly time frames, than daily and shorter ones. Thanks Chris for your excellent article about Elliot Waves theory and its use in the FX market. As I understand, Elliot waves theory can be mostly used in the higher time frames weekly and mainly monthly to be visible correctly.

While the market is forming, for example, Wave 3 on the monthly, a new cycle can be started on the daily chart and complete all the waves while monthly is still working on Wave 3.

Knowing the forming wave on the longer time frames like weekly and monthly, and so the market direction on these time frames, is a big help to trade the daily time frame properly and to take the right direction which is agreeable with the longer time frames. I am finding little difficult in understanding current Elliot wave pattern.

If I read this article couple of times, hope I will understand. In daily GBPNZD pair, current uptrend from 22April , I consider it as Wave 1, so can we expect as bigger wave 3 in future or the current wave is 3? Please see this Elliott Wave analysis which is to answer your question: Hi Chris thank you so much for another great article.

WOW, How everything make sanse. Thank you for sharing your knowledge and helping us for our better understanding of Market condition. Is it there any tool or indicator which can help us to determin and count the waves? ZIG-ZAG is cross my mind. There are some Elliott Wave indicators, but I have not tried them, because I believe indicators cannot show you the waves properly. It is something visual.

Also this script can be a good help: Thanks again for a very good article, Chris, Have found a book by R. So this can be very technical, but interesting, but as you say, many different views and interpretations to Elliott waves. Really great explanation I look forward to your posts they are always so helpful for a developing trader.

Again i want to thank you for sharing your knowledge so willingly. I read regarding the GBPCAD being in wave 5. Can you please tell me if my understanding is correct from the pic I have drawn. This is what I think too. Thanks for clear and clever explanation of Elliott waves. All your articles are very educative and highly useful. God Bless You Chris. Hi chris, Thank you so much. Different shapes of EW in Daily, weekly and monthly TF become much more understandable when you explain it in such simple terms.

I salute you for your tireless efforts. Thank you Chris, I have already read Elliott wave articles, but never in a such comprehensive, way. I am looking forward for the example that you plan to show us. I have one question.. This Elliot waves as you mention are sometimes impossible to read, or maybe simply they are not followed by the market. If this is the case, how we can notice when do we have to start a new cycle?

I hope I can get a better understanding of this concept, due to the fact I find it crucial for being consistently profitble.. Strong setups on the exhausted markets help us enter the market even when we know nothing about Elliott Wave analysis. I have explained it above. On a bull market, C will be the reversal as it is explained above. But it can be short if uptrend wants to be continued.

If we have a five wave up and then a reversal what is in between wave 5 up and wave 1 down? How do we recognize the difference between a reversal and an a,b,c? Waves 2, 4, A and C are all reversals. We take Wave C as reversal. Thank you for this great article that enlightens, and helps to understand, the price behaviour. Sorry for seeming not to get this. Everything you said I understand. I am wording my question wrong, If I am in an uptrend and see a reversal how do I know when it is now a down trend or just a correction to the up trend?

If it is based on a too strong candlestick pattern, then it is strongly possible that it forms a downtrend. SL has nothing to do with Elliott Wave. SL depends on the trade setup and is based on the trading system you are following. Thanks Chris, this is has been a wonderful piece of information. I have attached a chart kindly tell me if the marked wave is 1.

The beginning of Wave 1 is correct. But you ended it too early. Indeed, the end of Wave 1 is the high price of Would you consider the Elliot Waves on this monthly AUDCAD chart are drawn correctly C being not defined yet? It seems C is forming. If it breaks below the head and shoulders neckline while C is forming, then it will go much lower. Could you look at these and give an input? If this question is related to using Bollinger Bands as a help to find the waves, then it is not because of locating the trends.

It is because of locating the beginning of the fresh movements. The prefer to wait for a continuation to form at the end of wave 4, to enter at the beginning of wave 5 and follow the trend. After going through Eliot wave on a few different charts and then looking at the Fibonacci abcd which seems popular it looks as though with both systems are still taking trades on the 3 wave. Does this make sense? Could you please have a look in my Elliott Waves https: Everything looks good but the last part.

Where you have marked as the beginning of wave A is indeed the beginning of Wave 1 from the new cycle. Wave A starts from Wave B start from And, wave C start at Sometimes it is also too hard to identify the previous waves in the previous cycle too. The best and easiest thing to do is that first we wait for a too strong trade setup.

Then, our Elliott waves knowledge can help us to know whether the setup is formed at the right place and whether we can take it or not. We have been doing this on LuckScout for several months without talking about Elliott Waves.

I mean it is also possible to trade without knowing about Elliott Wave Theory. Sorry I missed the article name: If you mean we refer to the shorter time frames to maximize the profit, then I cannot agree, because you will see reversal signals on the shorter time frames more.

Referring to longer time frames can help you to maximize your profit. Plus, I think this setup is a reaction toward the 0. So, I think chances are good it will go up. Or do you think it will go down and test the 0.

Please, share your thoughts. But I am not crazy for the long trade setup that it has formed on the daily chart. Thanks Chris for the beautiful way that you explain and teach everything to us.

Could you please have a look on the below screenshot? It is GBPCHF Daily chart. Do you think that on this chart appears Elliott Wave 1? Get Our New E-Books For Free. Elliott Wave Analysis For Beginners: How To Use It Simply To Trade Forex And Stock Markets By: Elliott Wave Last Updated: Enter Your Email Address and Check Your Inbox: Wave A, B and C.

LEARN A PROVEN BUSINESS PLAN. June 27, at June 27, at 1: Jan Du Plessis says: June 27, at 2: June 28, at June 27, at 3: June 27, at 4: June 27, at 5: June 27, at 6: June 27, at 8: July 16, at 4: November 24, at July 15, at July 15, at 3: July 16, at 6: July 17, at July 18, at 7: MUSTAZAH ABDUL RAHIM says: June 28, at 1: June 28, at 2: June 28, at 4: June 28, at 6: June 29, at June 29, at 2: June 28, at 7: June 28, at 9: June 28, at 3: June 28, at 5: June 29, at 9: July 2, at June 29, at 4: June 29, at 5: June 29, at 6: June 29, at 1: June 30, at 2: June 30, at 1: July 1, at 2: July 1, at 3: July 1, at 4: July 1, at 7: July 1, at July 2, at 3: July 2, at 6: July 3, at 2: July 4, at 9: July 4, at 3: July 5, at July 10, at 4: July 10, at 5: July 11, at 3: July 11, at 4: July 26, at 8: July 28, at 7: July 28, at 8: July 31, at 8: August 16, at 6: August 17, at 3: August 27, at 5: September 10, at 3: October 17, at 3: September 4, at 6: September 4, at 7: The Easiest Way to Get Rich Fast.

Learn How to Get a Job with Mississippi Department of Employment Security Reaching What You Want without Doing Anything Candlesticks or Support and Resistance Levels? Making Excuses Is the Only Thing Some People Do How to Write a Business Proposal for the Business You Want to Start Recent Comments LuckScout on What Is Data Technology and How It Can Make You a Millionaire?

Joseph Kolade on What Is Data Technology and How It Can Make You a Millionaire? LuckScout on What Is Data Technology and How It Can Make You a Millionaire?

Abata Moses on What Is Data Technology and How It Can Make You a Millionaire? Success Business Blogging Trading Investment. Home LuckScout Mementos Contact About Archive Privacy Policy Terms. This Is More Important Than the Article You Are Reading:. Are You Enjoying Our Site? Our eBook Is Even More Important!