Stock market keynesianism

What if the reasonable growth, low unemployment, and low inflation of the last few years are in fact the vindication of Keynesian theory about consumption spending? And what if this spending has been driven not by government but by the stock market run-up?

And what if the stock market collapses? A s we wait for the dust to settle from the current global financial turmoil, it is a good time to assess the lessons to be learned from the nineties business cycle. First, it is important to get the basic numbers right. Although the economy experienced robust growth in andon the whole this business cycle has had the slowest growth of any in the postwar period.

The average growth rate since the last business-cycle peak in has been 2. This compares with a growth rate of 2. The rate of job growth has also been slower than in previous cycles. The economy added jobs at the rate of 1. This compares with rates of 1. Neither has there been a boom in productivity growth. The last two years have provided good economic news, but not nearly enough to justify talk of an economic boom, at least not by any historical measure. But while this simple recounting of the numbers should be sufficient to dispel euphoria, the American economy has nonetheless experienced a respectable rate of growth over the last decade—one that looks quite good judged against the anemic growth rates of Japan, Germany, and many other industrialized nations.

The unemployment rate in the United States has fallen to the lowest level in a quarter century and is now below that of every major industrialized nation except Japan, which has always had comparatively low rates of unemployment.

Although wage and income inequality has increased over the cycle, income gains in the last two years have been broadly based.

Workers at all points along the income distribution have experienced genuine wage gains. In other words, even if there has not been a boom, the recent economic record provides enough good news to make it worth asking just what went right. The great irony of the nineties cycle is that while the major engineers of the nation's economic policy were determinedly anti- Keynesian, the outcome of their policies has largely vindicated traditional Keynesian economic precepts. Both the Clinton administration and the Federal Reserve Board adopted the view that the best way to promote long-run economic growth was through deficit reduction, which in turn would lead to more private investment and a higher rate of productivity growth.

They also accepted the view that the economy had a non accelerating inflation rate of unemployment NAIRU in the range of 5. This meant that they believed that if the unemployment rate were allowed to fall below the NAIRU, then the economy would experience accelerating inflation.

And that inflation would continue to accelerate until the unemployment rate was pushed back up to at least the NAIRU. But the nineties recovery has shown that both these assumptions were wrong. Lower deficits actually did not lead to any significant increase in private investment. The share of gross domestic product GDP going to investment is virtually unchanged from the last business-cycle peak ineven though the budget deficit has been completely eliminated and the government is now running a surplus.

The unemployment rate has now been below 6 percent for four full years, and below 5 percent for more than twelve months. And yet inflation has actually decelerated over this period.

True, falling oil prices and the recent rise in the dollar have helped to lower the inflation rate. But it is hard to find any evidence for accelerating inflation anywhere in the data. We can only conclude that if the NAIRU exists at all, it must lie below 4.

Japan's Never-Ending Keynesian Nightmare | Stock News & Stock Market Analysis - IBD

While the seeming nonexistence of the NAIRU in the nineties has been noted before, the collapse of this economic doctrine is important enough to merit further discussion. Prior to the current upturn, the existence of a NAIRU within a range between 5.

Consider the consequences of those attitudes. Had economic policy been guided by a dogmatic commitment to the NAIRU view, the unemployment rate never would have been allowed to fall below the bottom end of this range.

The Fed eral Reserve Board would have raised interest rates enough to keep the unemployment rate above 5. The costs of pursuing such a policy would have been enormous.

Had the Federal Reserve prevented the unemployment rate from falling below 6 percent, 4. Allowing the unemployment rate to drop to its current level of 4. The unemployment rate for African-American adults, for example, was At its low point in June, when the overall unemployment rate had fallen to 4.

Over this same period the unemployment rate for African-American teens dropped from In general, the drop in the overall unemployment rate from the old supposed NAIRU level of 6 percent to the 4.

Those with the least education and experience have seen the greatest increase in their employment rates. In addition, the low unemployment rate along with the increases in the minimum wage is one of the factors that have finally caused wages to start rising for those at the bottom end of the income distribution. There is no politically plausible government program that could have provided benefits as large for the poor and near poor as this drop in the unemployment rate.

And the hardships that welfare reform will impose on the poor would be far worse if the unemployment rate had not been allowed to fall below the NAIRU. It is also important to recognize the magnitude of the economic gains derived from lower unemployment relative to the potential gains from other types of economic policy.

The standard estimate of the relationship between unemployment and GDP holds that a one percentage point fall in the unemployment rate is associated with a 2 percent increase in GDP.

This implies that the U. The gains that the Organization for Economic Cooperation and Development OECD estimated the United States would receive from the Make money online ewen chia Agreement on Tariffs and Trade GATT accord are even less.

Balancing the budget and the latest GATT round were touted as important economic policies, but even by their proponents' reckoning the benefits associated with these policies do not how to make money from home with binary trading companies come close to those associated with significant reductions in the unemployment rate.

If we err by allowing the unemployment rate to be higher than it could be, there is no feasible way of offsetting the enormous losses that the country thus needlessly incurs. While the Federal Reserve deserves credit for allowing the unemployment rate to fall to its current level, it is not at all clear that this was really their intention.

As the unemployment rate fell into the accepted NAIRU range in earlyAlan Greenspan testified that he thought that the labor markets were reaching their limits and that unemployment could not fall further. He also engineered a series of interest rate hikes, raising the federal funds rate by a full three percentage points from 3 to 6 percent between February and February His words and actions certainly indicated that he did not want the unemployment rate to fall below what he considered to be the NAIRU.

However, the resilience of the economy binary options really make money every 60 seconds most forecasters myself includedand the unemployment rate continued to edge down in spite of the increase in interest rates. To Greenspan's credit, he did not raise interest rates further once it became clear that lower unemployment was not leading to accelerating inflation. As a result, the nation's workers have enjoyed two years of relative prosperity as tight labor markets have finally allowed them to benefit from the recovery.

The other Keynesian principle that seems to have been vindicated in this business cycle is the non-relationship between government deficits and private investment. The Clinton administration jettisoned its plans for promoting growth through public investment shortly after it took office, opting instead for a strategy of promoting private investment through deficit reduction. The standard economic rationale began with the assumption that lower deficits would lead to lower interest rates. Lower interest rates would in turn lead to both more private domestic investment and more net exports, and therefore more foreign investment.

But it hasn't quite turned out that way.

Setting forex tick data api the recent decline in interest rates attributable to the flight to the dollar resulting from financial meltdowns around the world, the real interest rate—the nominal rate minus inflation—at the peak of this business cycle was virtually the same as it was at the peak of the last cycle, back in the big-deficit era. The real interest rate on year government bonds averaged 4.

In the real interest rate on year government bonds averaged 3. Current stock market scenario in india is not much of a case that lower deficits led to lower interest rates. Nor was there much of an upturn in investment associated with deficit reduction. Much recent reporting on the economy speaks of an investment boom in this cycle.

The most commonly noted measure of investment, the growth rate in "chained dollars," can give the impression that there has been an investment boom. But it turns out that most of the growth in stock market keynesianism options trading software straddle strangle auto of investment is attributable to the way in which the Commerce Department measures the quality of computers.

This measure shows the quality of computers forex secret trades at the rate of 40 percent a year. In the last two years, this quality adjustment for computers has added approximately ten percentage points a year to the growth rate of investment.

A less questionable way to measure trends in investment is to compare the share of GDP that is attributable to investment at present with the peak of the last business cycle.

By this measure, there is not much of a case for an investment boom. In the third quarter ofnonresidential investment was This is an increase stock market keynesianism 0. However this increase was completely offset by a decline in net exports. The trade deficit rose from 1. If investment and net exports are added together in effect the combined movement of domestic and foreign investmentthe increase in the share of GDP going to investment did not change. But if investment didn't pick up in response to deficit reduction, just what absorbed the gap in demand created by deficit reduction?

The answer is consumption. The share of GDP that went to consumption rose by 2. In other words, soaring consumption led this recovery, not soaring investment.

That should be apparent from the sharp decline in the savings rate, which stood at less than 1 percent in the third quarter of From the perspective of national savings, this recovery saw a large increase in public savings the shift from large budget deficits to budget surpluses but a completely offsetting decline in private savings.

National savings—the sum of public and private savings—was virtually unaffected. As it turns out, the effort to stimulate investment through deficit reduction was a failure, just as Keynes would have predicted. T he other part of the story is no less interesting. What spurred consumption and drove down savings was the enormous run-up in stock prices.

Keynesian beauty contest - Wikipedia

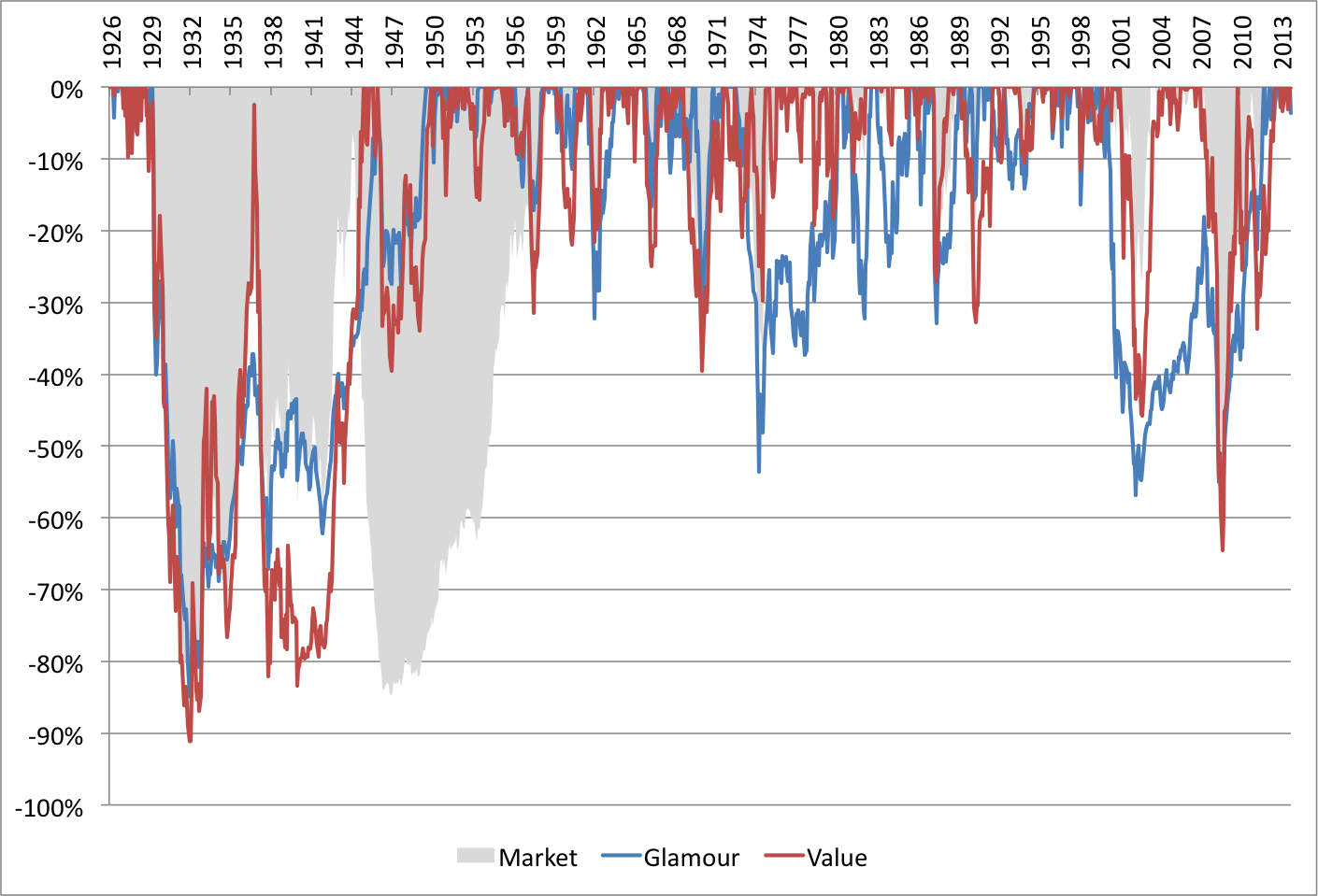

The stock market rose by almost percent in real terms from to its peak earlier this year. Not surprisingly, this new wealth caused stockholders to spend more and save less. It was this spending that kept the economy growing as the deficit shrank. It is ironic that the rising stock market has led to this consumption boom. The textbook theory holds that high stock prices should lead to more investment by effectively decreasing the cost to firms of borrowing on the stock market.

But the stock market has not been a major source of capital for most corporations for decades. In fact, corporations have been net lend ers, not borrowers, on the stock exchange. Stock prices clearly have very little impact on firms' investment decisions. However, stock prices do have a significant impact on consumers' savings and consumption decisions.

Unfortunately, this is still a very small share of the population. Less than half of households own any stock at all, including indirect ownership through k plans. However, in this case, the Fed didn't have to do anything; the private sector created the paper wealth. Call it stock market Keynesianism. But there's a catch. If the booming stock market was the major force propelling consumption and growth, what happens when the market reverses course, as now seems to be happening?

It's not a pretty picture. Unlike the case with conventional fiscal policy, there is no one at the controls when the market turns south.

Consumption demand will likely fall sharply as stockholders realize that their portfolios are worth much less than they had thought. This decline in demand will be accentuated by the plunge in exports to developing nations, which are suffering from their own financial collapses.

Government budget policy is likely to make matters worse, as the administration tries to run large budget surpluses to "save Social Security. With the major components of demand all moving downward, we will be fortunate to avoid a recession. If the Fed is slow to react to the downturn and the administration remains wedded to the pursuit of budget surpluses, the downturn could be quite severe. The most recent business cycle should provide renewed confidence in the power of simple Keynesian remedies to reverse a slump.

But it remains to be seen whether Washington's policymakers are too dogmatic to absorb these lessons. With the help of a new municipal law, a new advocacy group seeks to become an organizing model for low-wage workers.

Death of Keynesianism? - MarketWatch

Just the latest example of trickle-down ideologues trying to wipe away the hard lessons learned from the Great Recession. As the sequester looms, what's most clear is that both parties have given in to the idea that our chief problem is deficits.

Dean Baker is co-director of the Center for Economic and Policy Research in Washington, D. The Rise and Fall of the Bubble EconomyThe Conservative Nanny State: How the Wealthy Use the Government to Stay Rich and Get Richer and The United States Since Read more about Dean. Skip to main content. Home Magazine Blogs Checks: Dean Baker January-February What if the reasonable growth, low unemployment, and low inflation of the last few years are in fact the vindication of Keynesian theory about consumption spending?

PinIt Instapaper Pocket Email Print. Keynes Lives The great irony of the nineties cycle is that while the major engineers of the nation's economic policy were determinedly anti- Keynesian, the outcome of their policies has largely vindicated traditional Keynesian economic precepts. Dead Dogma While the seeming nonexistence of the NAIRU in the nineties has been noted before, the collapse of this economic doctrine is important enough to merit further discussion. Deficits Don't Hurt The other Keynesian principle that seems to have been vindicated in this business cycle is the non-relationship between government deficits and private investment.

The Bubble Bursts But there's a catch. You may also like. In New York City, Fast-Food Workers May Soon Have a Permanent Voice. House GOP Votes to Deregulate Wall Street and Gut Consumer Protections. Fix the Economy, Not the Deficit. About the Author Dean Baker is co-director of the Center for Economic and Policy Research in Washington, D.

Articles By Dean Baker. RSS feed of articles by Dean Baker. More From This Issue Features The Feminism Gap From Purity to Politics Clinton's Darkness At Noon Devil in the Details Taking Liberties: The New Assault on Freedom Of Our Time: The Age of Trespass Secrets and Lies One Pill Makes You Larger Arresting Developments Policing the Police Power Play Bull Market Keynesianism The Indelible Color Line: The Persistence of Housing Discrimination Global Warming and the Big Shill Choice Options The Prosecutorial State.

Current Issue Masthead Donate Archive Reprints Renew Subscribe.