Debit cash credit retained earnings

As we reported to AIPB members in their monthly technical briefing, The General Ledger newsletter www. At our request, Professors Jerome J. Stockholders' equity has two primary components: Contributed Capital Capital Stock and Retained Earnings, both of which have a normal credit balance. Contributed Capital shows shareholders' investment; Retained Earnings shows the company's accumulated net income or loss, less cash dividends paid, plus or minus prior period adjustments from the date that the corporation began to the present.

Contributed Capital and Retained Earnings are presented separately on the balance sheet to help users of the balance sheet understand where stockholders' equity comes from.

For example, two companies might have the same total Stockholders' Equity. A net loss at year end results in a debit balance in Income Summary because expenses debit balance are greater than revenues credit balance.

The debit balance in Income Summary is transferred to Retained Earnings, as follows:. Prior period adjustments corrections of errors after the books are closed that correct overstatement of the prior year's income are corrected with a debit to Retained Earnings.

For example, if after the books are closed you found an expense from last year that was debited to an asset account, the correction must reduce the balance in Retained Earnings as follows:. Cash dividends are shareholders' portion of earnings their return on investment distributed in cash rather than in stock or other assets.

The distribution is debited to Retained Earnings and credited to Cash. Dividends declared but not yet paid are also debited to Retained Earnings. Property dividends are distributions of noncash assets, such as stocks or bonds of other companies that the corporation owns. Revalue the stock or bond to its fair market value FMV , recognize any gain or loss, then distribute to shareholders and record as follows:. The shares are valued at their FMV and the distribution is recorded as follows:.

You can distribute Treasury Stock shares previously issued and bought back , or newly issued stock. Distribution of liquidating dividends distribution of all stock among shareholders is beyond the scope of this article.

Scrip Dividends , also known as liability dividends, are promissory notes to be paid, with interest, on a specified date, usually 6 months to 1 year in the future. When issued, the following entry is made:. A retroactive change in an accounting principle that results in the prior year's income being overstated is corrected with a debit to Retained Earnings.

For example, say that your firm changes from FIFO to LIFO for book and tax purposes. The prior year's income current Retained Earnings and tax liability must be revised downward as follows:.

Net income is recorded when total revenues credit balance exceed total expenses debit balance. The resulting credit balance in Income Summary is transferred to Retained Earnings as follows:.

Prior period adjustments that correct understatement of the prior year's income increase Retained Earnings.

Retained Earnings – Accounting Simplified

For example, if, after the books are closed you discover that prepaid insurance was mistakenly debited to Insurance Expense, then last year's income was understated. This is corrected as follows:. A retroactive change in an accounting principle that results in the prior year's income being understated is corrected with a credit to Retained Earnings.

For example, if your company changed from LIFO to FIFO for both book and tax purposes, the prior year's income and tax liability must be revised upward as follows:.

Debit/Credit Cheat Sheet

Changes from the cost to the equity method for investments in other companies. Your company might buy shares in its suppliers', customers', affiliates', or competitors' firm. Under the equity method, you record the investment initially at cost, then each year add to the Investment account the percentage of that company's earnings equal to the percentage of the company owned.

Record dividends from that company as a return on investment rather than as dividend income. The equity method results in a changing investment account balance. The entry for such a change is:. A retroactive change in an accounting principle that results in the prior year's income being understated.

For example, a retroactive change from the completed construction method to the percentage of completion method for long-term construction projects requires recognition of income earned and related taxes in each previous year rather than waiting until project completion.

The entry for the change is as follows:. Investment in ABC Co. Send a blank email to bookkeepingtips-on aipb. Send a blank email to bookkeepingtips-off aipb. Why Owners Love Their Retained Earnings Account —How to Handle it As we reported to AIPB members in their monthly technical briefing, The General Ledger newsletter www.

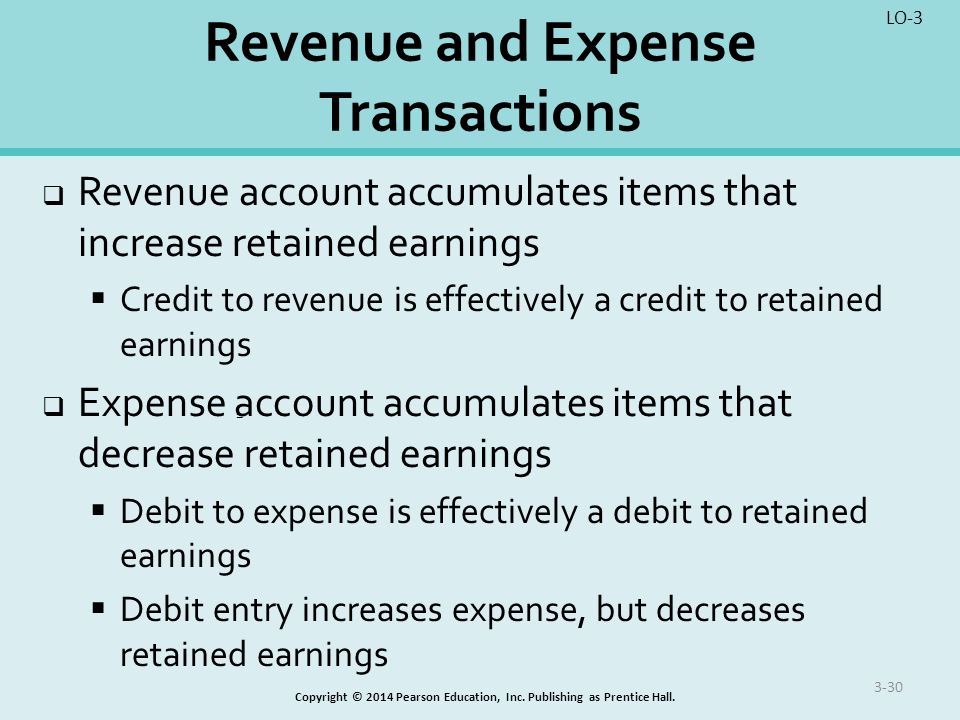

How Retained Earnings is classified Stockholders' equity has two primary components: Retained Earnings can be decreased by debited for: Net loss Prior period adjustments to correct overstated income Cash dividends Property dividends Stock dividends Scrip dividends A retroactive change in an accounting principle that results in the prior year's income being overstated.

Retained Earnings can be increased by credited for: Net income Prior period adjustments to correct understated income A change in accounting principle Changes from the cost method to the equity method to account for investments in other companies A retroactive change in an accounting principle that results in the prior year's income being understated Changes to Retained Earnings on the Debit Side Debit 1.

The debit balance in Income Summary is transferred to Retained Earnings, as follows: For example, if after the books are closed you found an expense from last year that was debited to an asset account, the correction must reduce the balance in Retained Earnings as follows: Revalue the stock or bond to its fair market value FMV , recognize any gain or loss, then distribute to shareholders and record as follows: The shares are valued at their FMV and the distribution is recorded as follows: When issued, the following entry is made: The prior year's income current Retained Earnings and tax liability must be revised downward as follows: The resulting credit balance in Income Summary is transferred to Retained Earnings as follows: This is corrected as follows: For example, if your company changed from LIFO to FIFO for both book and tax purposes, the prior year's income and tax liability must be revised upward as follows: The entry for such a change is: The entry for the change is as follows: